Rivian’s stock is getting some looks because the company lowered its delivery predictions for 2025, which might point to some difficulties coming up. They’re now thinking they’ll deliver at most 43,500 electric vehicles by the end of next year—that’s almost a 16% drop from last year’s sales. This new prediction came with Rivian’s third-quarter production and delivery report, which showed growth that wasn’t as fast as people thought, even though they’ve been making some improvements in production Lately. Experts are saying that the lower prediction shows there are problems like rising costs, supply chain problems, and a lot of competition in the electric vehicle market. Still, Rivian thinks they can grow big in the future as they work on making things more efficient, improving how they make things, and making more models. Investors are keeping an eye out to see if Rivian can make some changes in the next few months.

Rivian Stock Deliveries: Updated Guidance for 2025

So, Rivian did alright in the third quarter of 2025. They got 13,201 electric vehicles out the door, which is up from 10,661 in the second quarter and 8,640 in the first. That’s cool. They also made 10,720 EVs in that period, which suggests their production is getting more consistent after a rocky start to the year.Thing is, Rivian said they won’t deliver as many vehicles in 2025 as they did in 2024 and 2023, when they sold over 50,000 each year.This dropoff probably means Rivian’s still dealing with stuff like higher costs, supply issues, and loads of competition in the EV world. Even with these problems, they seem hopeful about the future. They’re trying to make production better, keep costs down, and put out new models to get more buyers interested. Everyone’s keeping an eye on them to see if they can make a big comeback in 2026.

Rivian’s Next Big Step: The R2 SUV

Rivian’s getting ready to release the R2 SUV, which should be their cheapest EV and maybe a big hit. It should be out next year. To keep up with orders, they’ve made their Normal, Illinois factory bigger and are building a whole new plant in Georgia. This new factory will make both the R2 and the R3 hatchback. That way, Rivian can make different kinds of cars and get more buyers. They’re shooting for big numbers, hoping to sell hundreds of thousands of these cars. By making more cars and selling cheaper models, Rivian wants to get a stronger spot in electric car market.

Rivian Stock and Trade Policy Challenges

Okay, so at the beginning of 2025, Rivian wanted to ship out 46,000 to 51,000 cars to equal what they did in 2024, which was 51,579. But, by May, they had to drop that estimate to 40,000–46,000 cars. This was because of new tariffs and trade stuff from the Trump administration that messed with how much it cost to make the cars and get the parts. Now, Rivian says they’re shooting for 41,500–43,500 cars this year. Basically, it’s tough trying to make more cars when global trade is weird, materials cost more, and shipping is a pain. They’re trying to make customers happy and keep investors calm. Rivian is changing how they do things to stay on target.

Rivian’s Position Against Competitors

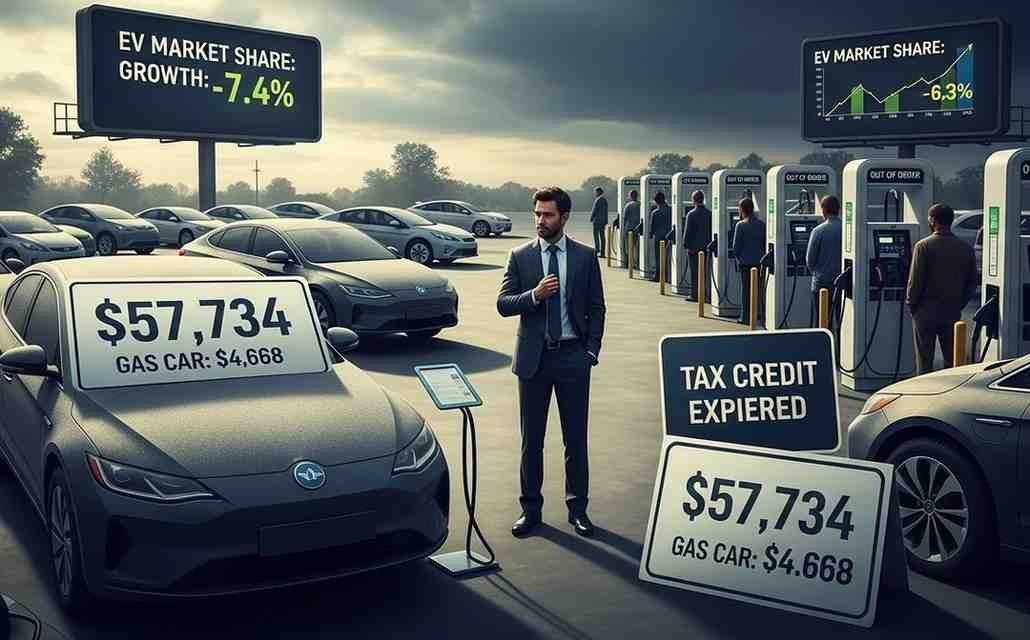

Unlike some old-school car companies, Rivian hasn’t completely cashed in on those federal EV tax breaks. Most electric car companies use the breaks to cut prices, but Rivian’s cars only got the credit when leased, not bought outright. So, they couldn’t use the government help to sell as much as some rivals. But Rivian’s boss, RJ Scaringe, is still positive. He thinks this might even help Rivian later on.Scaringe says a lot of car companies have been selling EVs at a loss just to get credits. They’re using government money as a crutch instead of trying to make a profitable EV business. These companies often need handouts to keep their EV stuff going. If the handouts shrink or vanish, they could lose out in the market. On the other hand, Rivian and other all-in EV makers, like Tesla, are all about electric cars. This gives them an edge because they’re built to do well even without subsidies. People buy their cars because they’re good, not just because of the breaks.This thinking makes Rivian sure of itself as it gets ready to make more cars and grow. They’re boosting how much they can make, launching cheaper models like the R2 SUV, and building new factories to keep up with demand. Scaringe thinks that as subsidies matter less, companies that lean on them might struggle. But Rivian and Tesla, which have been focused on making good electric cars from the start, will be in a better spot to do well.What this really means is that the EV market is growing up. At first, credits and subsidies helped get things going. But the companies that win in the future will be the ones that can compete without them. For Rivian, that means making cars that people want because of how they perform, look, and last, not because of government help. Scaringe is thinking long-term. Even though Rivian hasn’t gotten as many quick wins from federal credits, its all-EV plan means it could be a big deal in the electric car world for years

EV Market Struggles in the U.S.

Things are kind of shaky in the U.S. electric car market. The government is starting to cut back on help for people buying EVs and for green energy stuff. Because of this, some car companies are putting their EV plans on hold or just scrapping them altogether. Some are even trying to get rid of those tougher pollution rules.Even so, EV sales jumped up in the last three months. A lot of people wanted to get that $7,500 tax break before it went away. Tesla did really well, delivering more cars than ever before. This shows people still want EVs, even with all the policy changes and problems. It looks like the EV market is hanging in there.